Top SaaS Customer Acquisition Strategies for 2026

Customer acquisition strategy in B2B SaaS requires a systematic approach rooted in unit economics, buyer behavior analysis, and marketing channel strategy based on measurable outcomes. Successful acquisition isn't about implementing every available tactic—it's about identifying which specific strategies align with your ideal customer profile and your businesses metrics such as , customer LTV, and target CAC, sales velocity and so on.

Most B2B SaaS companies approach customer acquisition reactively. They test channels based on what competitors are doing, optimize for metrics like MQL volume, lead magnet downloads and scale spend before proving unit economics work at target CAC. This approach leads to bloated marketing budgets, declining conversion rates, and CAC payback periods that exceed available runway.

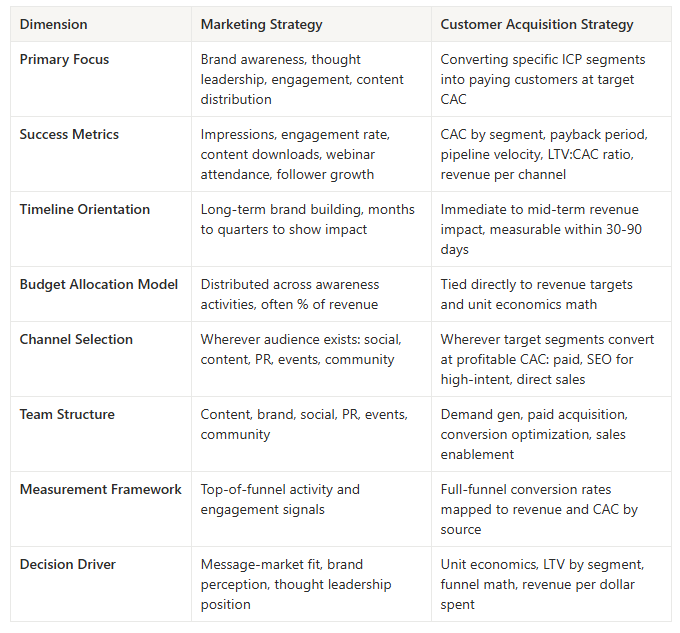

The difference between marketing strategy and customer acquisition strategy matters more than most teams realize. Marketing builds awareness, authority, and trust over months or quarters. Customer acquisition converts that foundation into paying customers at predictable economics. Both are necessary. But they require different measurement frameworks, budget allocation models, and team capabilities.

This article breaks down the 10 customer acquisition strategies proven to scale in 2026, the 5 biggest challenges teams face implementing them, and how AI fundamentally changes both execution velocity and buyer behavior in B2B software purchasing.

Biggest Challenges of SaaS Customer Acquisition Today

Attribution Is Still Broken

Most B2B SaaS companies track attribution using outdated last-touch or first-touch models that credit a single channel. This approach fundamentally misrepresents how B2B buyers actually make purchasing decisions.

The today’s reality of B2B buying behavior is the average buyer touches 8-12 different channels before converting on demo call or free trial. They read blog posts, click paid ads, attend webinars, download guides, join communities, and consume multiple content types across several weeks or months. Attributing the conversion to whichever channel happened last ignores the 7-11 touchpoints that actually influenced the decision.

Current tracking limitations compound the problem. iOS tracking restrictions, cookie deprecation, VPN usage, and ad blockers mean attribution data is typically 30-40% incomplete. Companies spending $50K+ monthly on paid media make budget allocation decisions based on fundamentally incomplete information.

Organizations that properly implement multi-touch attribution often discover their "worst performing" channels by MQL metrics actually generate the highest-LTV customers once the full journey is mapped correctly. Channel performance rankings frequently reverse when measured by revenue outcomes versus lead volume.

Targeting The Wrong Segments

A frequent scenario that happens is that companies optimize for conversion rate and lead volume instead of lifetime value and retention. Marketing performance dashboards show SMB accounts converting at 3x the rate of enterprise prospects, so marketing teams double down on SMB. Six months later, CAC payback is unattainable and annual churn reaches 45%.

The disconnect is that SMB segment converting faster might have for example $8K LTV with 18 months of average retention, while Enterprise deals taking 4 months to close could deliver $120K LTV with 5 year retention and negative net churn from expansion revenue.

Customer acquisition strategy cannot be separated from retention and expansion economics. The best customer segment for acquisition isn't the one that converts fastest, it's the one with the highest lifetime value relative to your customer acquisition cost and the longest retention period.

Before allocating acquisition budget, calculate segment-specific metrics:

- LTV by customer segment (not blended averages)

- CAC payback period by segment

- 12-month and 24-month retention rates by segment

- Expansion revenue potential by segment

- Sales cycle velocity by segment

Budget allocation should prioritize segments with the highest LTV:CAC ratios and acceptable payback periods, not simply the highest conversion rates. A segment with 3% conversion but $100K LTV and 6-month payback typically outperforms a 15% converting segment with $10K LTV and 18-month payback. That’s a math

Scaling Before You've Proven The Unit Economics

We can imagine scenario where company tests LinkedIn Ads for 60 days, sees decent MQL volume, and immediately scales budget 5x. Three months later, CAC is 3x target and only 12% of those MQLs became customers.

Teams frequently attempting to scale before proving the channel works at target economics. Increased spend often degrades conversion rates as you move beyond core ICP segments into broader, less qualified audiences. CPL might remain stable while cost-per-customer skyrockets.

The reality is that you can't scale what you haven't proven works at target economics. Before increasing spend, you need to answer:

- What is the actual CAC by channel (not cost per MQL or cost per lead)?

- What is the payback period for acquired customers from this channel?

- At what spending level do conversion rates begin degrading?

- Can the channel actually reach your best ICP segments at scale, or are you limited to a small addressable pool?

- What is the sales cycle length and win rate by lead source?

Companies spending $100K+ monthly on paid media without knowing their allowable CAC by segment, target payback periods, or segment-specific conversion rates are essentially running expensive experiments, not executing acquisition strategy.

Treating Every Marketing Channel Like Performance Marketing

Not every acquisition channel operates on the same timeline or conversion model. Yet most SaaS teams try to measure content marketing, community building, and brand awareness using the same 30 day CAC metrics they use for paid search.

Today prospect reads 8 of your blog posts over 3 months, joins your Slack community, attends a founder webinar, then converts. Your attribution model credits the webinar, but which touchpoint actually drove the decision? All of them.

Long-cycle channels like content, SEO, and community require different measurement frameworks. They're building pipeline velocity and trust over quarters, not driving conversions in days. Companies that kill these channels because they don't show immediate CAC wins are systematically destroying their most defensible acquisition assets.

The data shows that B2B SaaS companies with mature content engines and engaged communities have 30-40% lower CAC than competitors relying purely on paid acquisition.

Apply different success metrics to different channel types following this measurement framework:

- Immediate conversion channels such as paid search, retargeting: 30-90 day CAC, direct attribution

- Medium cycle channels such as paid social, webinars, partnerships: 60-120 day influenced pipeline, multi-touch attribution

- Long cycle channels such as SEO, content, community: 6-18 month influenced pipeline, engagement-to-conversion analysis, cohort-based CAC

Ignoring The Signal: Your Best Customers Are Telling You Where To Find More

Most companies run identical acquisition campaigns for 12-18 months without analyzing which specific customer segments generated actual revenue. They track aggregate metrics like overall conversion rates, blended CAC, total MQL volume, without segment-level analysis.

Let’s put into example that one B2B SaaS company acquires 500 customers across multiple segments and sources and their dashboards display aggregate performance. What remains hidden is that 60% of total revenue comes from 15% of customers, a specific vertical, company size, and use case that converts at 3x the baseline rate with 5x the average LTV.

Despite this signal, 70% of acquisition budget continues flowing to generic campaigns targeting broad audiences rather than the specific high-value segments proven to drive revenue.

Strategic framework

- Map your highest-LTV customers back to their acquisition source, campaign, and ICP characteristics

- Identify common patterns among top-performing customer segments

- Calculate CAC, conversion rates, LTV, and payback periods by segment

- Reallocate acquisition budget toward segments and channels delivering revenue at target economics

- Develop segment-specific messaging, landing pages, and conversion paths

This requires integrating data from marketing automation, CRM, product analytics, and billing systems to understand which acquisition sources generate customers who activate, retain, and expand. Most companies have this data, they simply haven't connected it into actionable segment intelligence.

Key Differences Between Marketing and Customer Acquisition Strategy

Marketing builds the foundation such as authority, trust signals, content assets, community, and brand recognition. Customer acquisition converts that foundation into revenue at predictable economics. Most companies either over-invest in marketing without acquisition systems to convert the awareness, or they scale acquisition channels without the content and trust assets to support efficient conversion.

The companies winning in 2026 aren't choosing between marketing and acquisition. They're aligning both under unit economics and revenue targets, with clear attribution, separate measurement frameworks, and cross-functional execution that actually connects awareness to revenue.

10 Effective Customer Acquisition Strategies That Will Scale in 2026

1. Content Marketing

With AI tools like ChatGPT, Jasper, and Claude, content production velocity increased 5-10x in 2025. But speed without strategy just creates more noise. The companies winning are using AI to scale execution of a clear content to revenue map. Still most B2B SaaS content strategies are built backwards. Teams publish 40 blog posts per quarter, track organic traffic, and celebrate engagement metrics while signups barely move.

Instead start with your revenue segments and funnel math, then build content that maps to customer acquisition economics. Identify the 5-7 core topics your highest LTV customers searched for before converting. Then create comprehensive and optimized content that targets those specific buyer intent signals.

2. Community Building

Community is not nice to have anymore it’s mandatory. Software buying behavior changed for searching for software vendors to build in public with your audience and getting together around solving common problems. That’s what build trust and authority today.

The data shows that B2B software companies with active communities see 25-40% lower CAC and 60% higher retention than competitors without community assets. Why? Because community de risks the buying decision. Your prospects see real users solving real problems with your product before they ever talk to sales. Active community experience becomes more valuable as it grows—which creates a network effect that compounds acquisition efficiency.

3. SEO (With GEO and AIO Optimization)

SEO still plays an important role in customer acquisition, but traditional SEO strategy will be drastically changed in 2026. Google's Search Generative Experience, AI overviews, and the rise of AI search engines like Perplexity are fundamentally changing how buyers find and evaluate software.

What will work in 2026:

- Structuring content so AI models can parse and cite it in generated responses

- Creating comparison content that positions your product in AI generated "best of" lists

- Optimizing for the questions AI assistants use to research B2B software decisions

- Building authoritative content that AI models reference as trusted sources

The companies winning SEO in 2026 aren't just ranking on Google. They're getting cited by AI systems when prospects ask: "What's the best in your category for specific use case?"

Follow technical implementation and use structured data markup, clear section headers that AI can parse, comprehensive comparison tables, specific use case documentation, and citation-friendly formatting. Your content needs to work both for human readers and AI systems extracting information.

4. PPC Advertising

Paid acquisition playbook starting 2026 will be drastically changed. Platform updates, AI powered ad systems, and increased competition made the old "launch campaigns and optimize for conversions" approach too expensive for most B2B SaaS unit economics.

Paid media campaigns built on unit economics and revenue projections, not platform optimization is the crucial pivot that will happen in 2026. If you feed Google's AI bidding and Meta's Advantage+ automation with right conversion events and value signals you’re maximizing chances for success. Most companies optimize for form fills or demo bookings without telling the platform which bookings actually converted to revenue. The AI optimizes for activity, not outcomes.

Feed actual revenue data back to ad platforms through enhanced conversions. When a lead converts to a $50K customer, that signal goes back to Google/Meta/LinkedIn. The AI learns which clicks drive revenue, not just demos.

5. Sales Automation and Personalization

Sales-led customer acquisition in 2026 isn't about more outreach at scale. It's about better outreach, executed at scale through intelligent automation.

AI influence lead to drastic changes in sales workflows and how BDR and SDR teams operates. We’re leaning more to strategic human direction combined with AI tactical execution. Sales teams identifies ICP targets and crafts positioning strategy. AI handles account research, email personalization, meeting scheduling, CRM logging, and follow-up sequencing.

The process started in 2025 will continue to envolve in 2026

- AI-powered account research with tools like Clay, Apollo, and Cognism automatically enrich prospect data with company signals, tech stack, funding events, and buying triggers

- Dynamic personalization at scale with AI tools generates customized email copy, LinkedIn messages, and video scripts based on prospect characteristics.

- Automated meeting scheduling and CRM hygiene. AI handles the back-and-forth of booking meetings and automatically logs all activity without sales rep manual entry

- Predictive lead scoring with advanced AI models trained on your closed-won data identify which prospects actually have revenue potential vs. which are time-wasters

6. Social Media Marketing

Social media as a customer acquisition channel fundamentally shifted in 2025. Companies shifting to founder-led content and systematic programs employment advocacy. B2B tech buyers trust individuals. When your founder shares insights on LinkedIn, engagement is 10x what your company page gets, when your employees share authentic product stories, conversion rates are 4x higher than paid social ads.

B2B SaaS companies with active founder social presence generate 30-40% more inbound pipeline than competitors where founders are invisible. LinkedIn is the second-highest converting channel after direct for most B2B companies, but only when executed with authenticity and consistency.

Block 2 hours per week for founder content creation, write about actual challenges, lessons, and insights from building the business. Share customer wins, comment on industry trends, be useful and authentic, not promotional.

7. Webinars and Podcast Guesting

Thought leadership is a game changer in B2B in the last 10 years, founder-led webinars and podcast appearances are high-leverage customer acquisition channels that compound over time.

The pattern I see: Most founders avoid webinars and podcasts because they don't see immediate CAC metrics. But here's the reality—buyers do 70% of their research before ever talking to sales. When they find your founder teaching a comprehensive workshop or sharing insights on a trusted podcast, it builds credibility that accelerates sales cycles and increases win rates.

The framework of most influential B2B SaaS founders and executives:

- Monthly or weekly founder webinars with live teaching sessions on specific use cases or industry challenges, not product demos.

- Strategic podcast guesting with targeted podcasts your ICP actually listens to. One appearance on the right show generates more qualified pipeline than 10 appearances on generic business podcasts.

- Webinar evergreen content. Record live webinars, then repurpose into on-demand content that generates leads for 12-18 months after the initial event.

8. Events and Conferences

After COVID restrictions in-person events and conferences made a full comeback in 2024. Events work for high ACV B2B SaaS where relationship building accelerates relationships and deals. They don't work as a volume acquisition channel. Pick 3-5 strategic events per year where your best customers actually attend, then execute with proper plan.

9. Partner and Integration Ecosystem

A properly structured partner and integration ecosystem delivers 20-30% of new customer acquisition at near zero CAC. Integration partnerships work best for B2B SaaS with clear workflow connections to established platforms. If your tool naturally fits into an existing tech stack, partnerships become acquisition channel that compounds as the ecosystem grows.Deep integrations with 5-7 core platforms. Co-marketing partnerships with joint webinars and shared content. Marketplace presence in partner app stores. Partner-sourced deals with systematic referral programs.

10. Referral and Advocacy Programs

Customer referrals deliver the highest LTV and lowest CAC customer base. B2B SaaS companies with mature referral programs generate new customers with 50-70% lower CAC and 30% higher retention than other channels. Systematic referral programs with clear incentives, easy execution paths, and continuous optimization is key to success.

The framework you can implement is:

- Identify your advocates: Score customers by satisfaction, engagement, and industry influence. Your top 10-20% are referral candidates.

- Build valuable incentives such as cash rewards work better than credits or swag. $500-2,000 per qualified referral depending on your ACV.

- Make it stupid easy. Give advocates referral links, templated messages, and social assets. Remove all friction from the referral process.

- Create advocacy tiers. Bronze, Silver, Gold referral statuses with increasing benefits.

- Systematize asks. Build automated campaigns that ask for referrals at high-engagement moments—after product milestones, positive support interactions, or successful outcomes.

What's Coming Next in SaaS Customer Acquisition

Customer acquisition in 2026 isn't about discovering radically new channels. It's about systematic execution of proven strategies, amplified through intelligent automation and measured against unit economics.

The companies winning customer acquisition in 2026 and beyond aren't chasing the next growth hack. They're building systematic acquisition engines rooted in unit economics and measured against actual revenue outcomes. Strategy still needs human direction but execution can now scale 10x faster through intelligent automation.

The next phase of SaaS customer acquisition isn't about doing more. It's about doing what actually works - systematically, measurably, and at scale.

.webp)